Acquisition project | Tira

For Every You

Elevator Pitch

Introducing Tira, a revolutionary beauty and skincare E-commerce platform launched in 2023. Tira is your one-stop destination for accessible yet aspirational beauty with premium, globally-sourced beauty and inclusive skincare solutions. We empower our customers with the ability to discover, compare, and purchase from a wide range of high-quality products. We celebrate individuality and empower you to embrace your unique beauty.

Our platform is designed to cater to all skin types and beauty preferences, providing personalized product recommendations based on individual skincare needs. With Tira, you can enjoy a seamless online shopping experience, expert advice, and fast, reliable delivery. Join us on our mission to make beauty and skincare accessible, personalised, and sustainable.

Understanding the Product

About the Product

Product Selection Framework and Statistics

Status | Description |

|---|---|

Internet First Product | Yes |

PMF Reached | No, Tira has recently completed one year and is trying to gauge user attention with offers and paid ads. |

Revenue Statistics | 378 Crores (assumption based on traffic and competition revenue stats) |

Usage Frequency | Medium |

Willingness to Pay | Yes |

Bragworthy | Yes, they have quite a lot of exclusive imported products now so that makes it brag worthy but the app still has less product variety and takes higher lead time in delivery compared to its competition. |

Funding Details

- Tira has not raised any fundings as they are backed by retail giant Reliance retail.

Core Value proposition?

The core value proposition of Tira by Reliance India lies in its commitment to inclusivity and personalized skincare solutions. Tira Beauty recognizes and celebrates the diversity of individuals' skin types and hair conditions, offering a wide range of products designed to address various needs. Whether you're dealing with specific skin concerns or hair issues, Tira Beauty ensures that everyone can find the perfect solution tailored to their unique requirements. With a focus on inclusivity and personalised care, Tira Beauty empowers individuals to embrace their natural beauty and feel confident in their own skin.

What problem does the product solve?

Tira is solving the same problem as their competitors but in a unique manner.

They are trying to solve the problem of limited accessibility and inclusivity in the skincare and beauty industry. Many individuals struggle to find products that cater to their specific skin types, concerns, and hair conditions due to the lack of options available in the market. This can lead to frustration, dissatisfaction, and ineffective skincare routines.

Tira addresses this problem by offering a diverse range of products that accommodate a wide spectrum of skin types, concerns, and hair conditions. By providing inclusive solutions and personalised recommendations, Tira ensures that everyone can find suitable products to meet their unique needs by not only simplifying the shopping experience but also empowering individuals to embrace their natural beauty with confidence.

How does the product solve the problem?

Tira tackles the problem of limited accessibility and inclusivity in the skincare and beauty industry through several key strategies:

- Diverse Product Range: Tira Beauty offers a wide array of skincare and haircare products, catering to various skin types, concerns, and hair conditions. This expansive range ensures that customers have access to products specifically formulated to meet their individual needs.

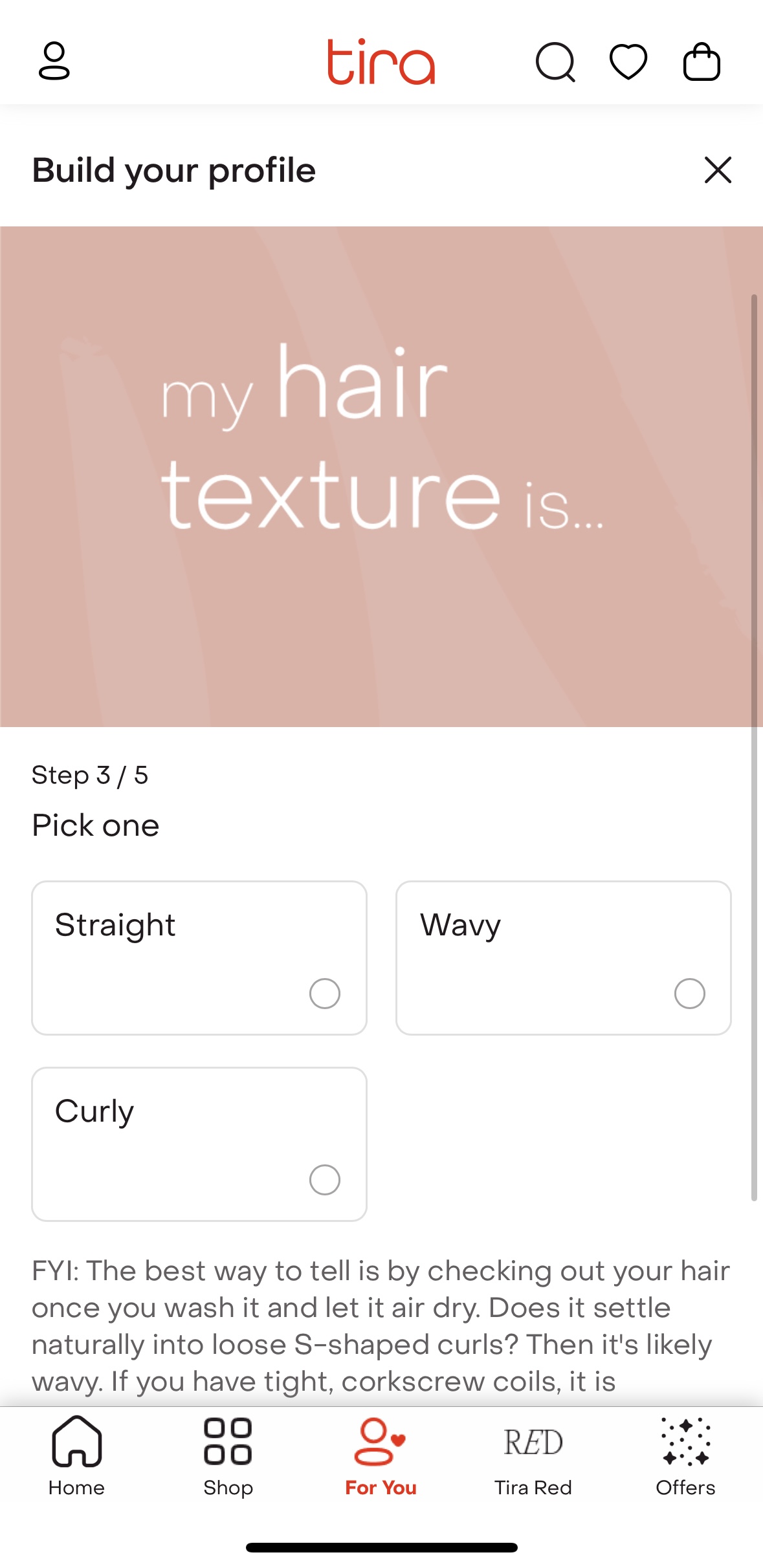

- Personalised Recommendations: Through its online platform, Tira Beauty provides personalised recommendations in its "for you" section based on customers' unique skin and hair profiles. By understanding each customer's specific requirements, Tira Beauty ensures that they find the most suitable products for their needs, enhancing the effectiveness of their skincare and haircare routines.

- Expert Advice and Tips: Tira offers expert advice and tips to guide customers in selecting the right products and optimising their skincare and haircare routines via their "Tire Tube" section. This guidance helps customers make informed choices and achieve the best results for their individual concerns.

- Inclusivity: Tira embraces inclusivity by ensuring that its product offerings cater to a diverse range of skin types, concerns, and hair conditions. By prioritising inclusivity, Tira Beauty aims to empower individuals of all backgrounds to feel confident and beautiful in their own skin.

Overall, Tira's multifaceted approach to product selection, personalised recommendations, expert guidance, and inclusivity effectively addresses the problem of limited accessibility and inclusivity in the skincare and beauty industry, enabling customers to discover products that truly meet their unique needs.

Ideal Customer Profile

ICP Research

Based on discussions made in the office and with friends, we jot down the demographics, interests, and problems faced by our ICPs

| Persona Type | ICP 1(College Students to Freshers) | ICP2 (Junior level to Mid-level professionals) | ICP3 (Mid senior professionals to Leaders) |

|---|---|---|---|

| Demographics | |||

Age | 16-24 | 25-40 | 41 and above |

Gender | Male, Female | Male, Female | Male, Female |

Location | Tier 1 & 2 cities | Tier 1 & 2 cities | Tier 1 |

Marital Status | Single/Married | Single/Married | Single/Married |

Employment Status | Dependent on parents/Employee | Employee | Employee/Self Employed |

Income Range | 4L-12L Per Annum | 12L-60L Per Annum | 60L Per Annum and above |

Example Professions | Intern, SD1, Teacher, Junior Product Manager, Associates, etc. | Senior Product Manager, Key accounts manager, Senior Project Manager, etc | CXO, Founder, Principal, Dean, Head of Product/Tech |

| Interests | |||

Frequently Used Apps | Social - Reddit, iMessage, Snapchat, Instagram, BeReal, Whatsapp Shopping- Amazon, Flipkart, Zara, Zepto, Shein, H&M, Myntra, Nykaa. Food- Zomato, Swiggy Payment- Google Pay, PayTM, Phonepe Music- Apple Music, Spotify, etc. Learning: Byjus, Udemy, Udacity | Social - Whatsapp, iMessage, Instagram, X. Shopping- Amazon, Nykaa, Flipkart, Zepto, Myntra Food- Swiggy, Zomato Payment- Google Pay, PhonePe Work Apps- Slack, Teams etc. Networking- Jio Saavn, Spotify, YT Music Reading & Answering- Reddit, Quora, etc. | Social - Whatsapp, Instagram, Facebook, X. Shopping- Amazon, Flipkart, Zepto, Nykaa Food- Swiggy, Zomato Payment- Google Pay, Business Apps- Slack Networking- Linkedin, Music - Jio Saavn, Spotify, Reading & Answering- Reddit, Quora, etc. |

Favourite Pastime | Consuming content on OTT, parties on weekends | Travelling, Consuming News, OTT content, enjoys exploring, read blogs and articles from thought leaders | Read blogs and write content on the industry, politics, and current affairs |

| Goals | |||

Scale on which they want to invest? 1 to 10 | 7 | 9 | 5 |

Current Solution? | Try different apps to order or import using friends & relatives. | Use different apps to order or pay import fees to get stuff imported. | Use a single app that they’ve been using for sometime now. |

| Persona Type | ICP 1(College Students to Freshers) | ICP2 (Junior level to Mid-level professionals) | ICP3 (Mid senior professionals to Leaders) |

|---|---|---|---|

Ease of adoption -Need -Awareness -Willingness to Pay | Need- 9 Awareness- 9 Willingness to Pay- 6 | Need- 8 Awareness- 7 Willingness to Pay- 8 | Need- 9 Awareness- 2 Willingness to Pay- 8 |

Usage Frequency | High | Medium | Low |

Purchasing Potential | Low | High | High |

TAM Size | High | High | Low |

Distribution Potential | High | High | Medium |

Priority | P0 | P1 | P2 |

Final ICP Selection

Prioritised based on the following:

- Ease of Adoption

- High-Frequency Usage

- Appetite to Pay

- Sizeable TAM

- Distribution Potential

Based on the ICP prioritisation framework, ICP1 and ICP2 are what we’ll be prioritising considering their willingness to pay, TAM and usage frequency.

ICP3 has the lowest TAM and distribution potential but higher need than the others. If we do the ICP1 and ICP2 right, the ICP3 will be much easy to target as ICP1 and ICP2 can act as influencers later on.

The Market

Total Addressable Market (TAM) Calculation

We are using the top down approach to calculate the market.

India’s total population as of now: ~143 Crores

India’s population over 16 years of age: ~108 crores = ~75% (Ref: Wikipedia)

Urban Population in India: ~52 Crores

Urban Population over 16 years of age: 75% of 52 crores = ~39 Crores

People who are beauty and skincare Ecommerce users: ~60% of 39 crores = 23.4 Crores

Serviceable Addressable Market (SAM) Calculation

Looking at our ICPs and neglecting people who don’t use Ecommerce for beauty and skincare products:

% of people who take action : 80% X 23.4 crores = 18.7 Crores

Considering the multiplies, the SAM comes to be around Crores people.

Serviceable Obtainable Market (SOM) Calculation

These are the people who use beauty and skincare products on a regular basis. Out of these, some people would still use competitor brands like Nykaa and will take sometime in switching to a new product.

% of people who can switch to a new product with acquisition techniques like better discounts and social media content: 50% of SAM = ~9.35 Crores

Acquisition Strategies

Channel Selection Framework

| Channel | Cost 💰 | Flexibility 🧘 | Effort 🔨 | Speed 🚅 | Scale 🪴 |

|---|---|---|---|---|---|

| Organic ✅ | Low | Medium | High | Slow | Medium |

| Referral | Medium | Medium | High | High | High |

| Paid Ads ✅ | High | High | High | High | High |

| Product Integrations | High | Medium | Medium | High | High |

Organic

The reason we are going ahead with organic is because it helps with gaining a loyal audience base and builds a stronger community that can generate a lot of WoM.

- Topical On-Ground Activations and Events: Tira Beauty can enhance its brand presence by organising on-ground activations and events that align with current trends or social issues. For example, hosting makeup workshops or beauty masterclasses themed around seasonal trends or cultural celebrations can attract a diverse audience and generate buzz around the brand. By actively participating in relevant community events or partnering with local organisations, Tira Beauty can establish itself as a socially conscious brand that is engaged with its audience beyond just selling products.

- User-Generated Content on Social Media: Tira Beauty can leverage user-generated content on social media to amplify its brand presence and connect with a wider audience. Collaborating with influencers and celebrities for campaigns like "Timeless Trends By Tira" not only adds credibility to the brand but also exposes it to the influencer's followers. Additionally, launching initiatives such as "Every Me With Tira" where influencers and customers share their makeup looks using Tira products can create a sense of community and authenticity around the brand. The mood palette microsite idea further encourages user engagement by providing personalised makeup recommendations, encouraging users to create and share content based on their unique experiences.

- Launch Beauty Clinics: Introducing beauty clinics that offer personalised skincare and makeup consultations can significantly expand Tira Beauty's brand presence while providing added value to customers. By deploying a team of skincare and makeup experts who can analyse customers' skin or beauty needs remotely and recommend tailored solutions, Tira Beauty establishes itself as a trusted authority in the beauty industry. This service can be integrated into the Tira Beauty app, allowing customers to book virtual appointments and receive expert advice from the comfort of their homes. Offering personalised consultations enhances customer loyalty and positions Tira Beauty as a brand that cares about its customers' individual needs, ultimately strengthening its brand presence in the competitive beauty market.

- Launch organic content series: India has a diverse culture and every culture celebrates weddings at a very large scale. Creating a content series that celebrates brides from all these cultures can help with generating organic chatter while seamlessly integrating Tira for bridal makeup. These content pieces can be hosted on brands own YouTube channel and can be repurposed as reels/YT shorts on the other social media platforms.

Paid Ads

The reason we went ahead with Paid Ads and discounts is because it helps driving awareness and can lead the audience to the organic content which in turn helps increase the community and brand recall.

Channel Selection:

| Channel name | Cost | Flexibility | Effort | Speed | Scale | Budget | User Insights |

|---|---|---|---|---|---|---|---|

Google search | Medium | High | Medium | Low | Medium | 20% | Search volumes are super high. |

Youtube | High | High | HIgh | Medium | High | 20% | 5 seconds to skip, 5 seconds for a good value prop. |

Quora | Medium | High | Low | Medium | High | 10% | Experimenting here initially. ICPs that are willing to adopt a new product are more active here. |

Medium | High | Medium | High | High | 20% | High Usage of this platform | |

Tinder/Bumble/Hinge Banners | Medium | Low | Medium | High | High | 10% | ICPs make their transactions here. |

Influencer Marketing | Medium | High | Medium | High | Medium | 20% | Beauty influencers are trusted a lot in the country |

Total | 100% |

Google Search

According to the keyword research I did, the effort and CPC required to be ranked high on Google is medium.

The search volume for the given keywords is very high.

- Makeup

- Skincare

- Oily Skin

- Acne Scars

While the CPC is pretty average compared to other industries.

Sample Google Ad:

Headline 1: Oily Skin hinders your Grin?

Headline 2: Download Tira now.

Description 1 (90 characters): Tira got your back. Download and Show Now #ForEveryYou

Description 2 (90 characters): Experience meets innovation. Streamlined investments. Trusted by seasoned investors.

Display URL: www.tirabeauty.in

YouTube

YouTube media distribution can play a key role in acquisition and will give the best ROI.

It has the highest distribution among the other channels.

We do two things here:

- Influencer marketing

- Beauty Influencers like Kritika Khurana , Malvika Sitlani , Somya Gupta are trusted more than the paid ads these days. We will collaborate with them and ask them to make a super organic review video for Tira products experience.

- YouTube Ads

Tira X Kareena Kapoor (#ForEveryYou)

Instagram Ads

Instagram is great platform to create brand image of inclusivity and get UGC using influencers and celebrities for different campaigns like “Every Me With Tira” where users can show pictures of them with their favourite product. People have different skincare routines and the community can be built around the same idea where people create videos of their daily routines and towards the end an expert can react to different videos and suggest add on products.

Dating app Banners

Our ICP is mostly available on the popular dating apps like Bumble, Tinder, Hinge, etc. This audience is always trying to show their best self so Tira banners can be seamlessly integrated on such platforms as the TG and inclusivity message works very well here.

Proposition:

Be date ready with Tira. #ForEveryYou or Swipe right to daily skincare.

Quora

Quora is super SEO friendly and once you’re in, it’s difficult to get out. We want to run ads here on the relevant keywords as answers to certain questions. This market is still pretty big and a lot of people are still trying to know more and more about skincare and makeup so we can direct these users from Quora to Tira’s website and onboard them as fresh users to drive action.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.